The Statement of Individual Situation (RIS), better known as relevé de carrière tous régimes, is a document that allows each insured person to know the pension rights he or she has acquired to date. This allows, in particular, to find out how many quarters are left to confirm to receive a full pension, that is, without a reduction. The RIS also serves as the main document for estimating your future pension.

During pension calculations, pension fund specialists rely on RIS to re-establish your career path. Therefore, it is very important to know how to decipher it so that you can summarize and eliminate any omissions or errors that could have serious consequences for your retirement.

Where can I find my RIS?

The RIS is mailed every 35 years to the policyholder, then every 5 years thereafter. Starting at age 55, it is accompanied by a global indicative estimate (EIG), which provides an understanding of the future pension based on entitlement, and according to the retirement age, between the legal age of 62 and 67, the full basic retirement age. rate (that is, without reduction).

You can also review your rights at any time using your electronic RIS or e-RIS. To do this, simply register on the site lassuranceretraite.fr, using your social security number and order it through the Mes demarches menu. In a few minutes, the document will be available in PDF format in your personal account, you can download and print it if necessary.

Write to me, I will send you instructions on how to obtain this document

How to decrypt RIS?

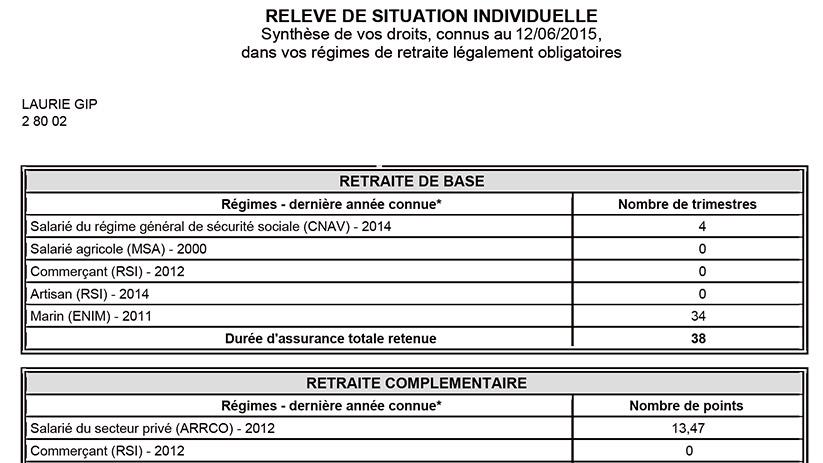

The first page is a summary of the rights acquired. It mentions the basic and supplementary pension schemes to which the insured is currently contributing, as well as those to which he has contributed in the past if he has changed his occupational status.

For each of these modes, the number of confirmed quarters (for receiving a basic pension) or the number of accumulated points (for an additional pension) is specified. The number of quarters required to receive your full pension (without reduction) is indicated at the bottom of the summary. This number varies depending on the year of birth of the insured.

The RIS details the acquired rights for each regime on one or more pages, depending on the career and professional experience of the insured. Each page shows the year, the name of the employer or the nature of the period (unemployment, sickness, etc.), the amount of contributions for basic schemes, the number of quarters confirmed or the number of points received.

Why is the stated salary sometimes lower than the received salary?

The certificate indicates your annual BRUT SECURITE SOCIAL income, that is, income before tax and social contributions. Compare it with your salary slip for December of the corresponding year.

The annual income taken into account when calculating the basic pension of employees, agricultural employees, self-employed people, artisans, merchants, business managers and clergy (priests, pastors, etc.) is limited. They cannot be higher than the Annual Social Security Cap (PASS), which is reassessed annually.

Thus, on January 1, 2021, PASS is left at the 2020 level of 41,136 euros. This means that even if the insured person earns more than this amount, contributions to the basic part of the pension are limited to this ceiling. Until 2005, in the case of multiple employers, the entire annual salary was taken into account to calculate contributions.

Note: If you work in the private sector, to confirm the quarter it is enough to confirm 150 paid hours (SMIC) - 1554.58 euros gross in 2021. By contributing 6,218 euros gross (1,554.58 x 4) this year, the insured will confirm his pension rights for 2021. It is not possible to confirm more than 4 quarters per year. Before 2014, the equivalent of 200 hours of minimum wage was required to qualify for a quarter. In the civil service, the quarter for retirement is confirmed every 90 days of service.

What information is not shown in RIS?

In all modes, mothers are given a quarter or extra points for pregnancy and childbirth. For example, employees are entitled, under certain conditions, to 8 quarters (2 years) per child, and female civil servants are entitled to 4 quarters (1 year) per child. However, these “free” quarters and points are not reported in the RIS. Pension funds are waiting for pension rights to be claimed before adding them. This is why it is important to include a copy of your family record with your retirement application.

Another “normal” absence: military service. The Army needs time to transmit information to pension funds. If military service prior to the insured's 50th birthday has not yet appeared in the RIS, you will need to report this to your pension fund.

What to do if the certificate contains incorrect information?

It is necessary to alert your pension fund to the slightest irregularity or the slightest error in your RIS. It is important that the information on the certificate is as complete and accurate as possible at age 55, which is the age at which the EIG is sent. If the information is incorrect, the pension estimate will be incorrect. 1, preferably 2 years before retirement, you should check all the points of your RIS and correct them with your fund.

Want to know how much you will receive in retirement?

Sign up for a consultation. Here I will calculate your pension rights based on your professional status and work experience, and help you decide on your age and financial goals in retirement. I will also select a solution that will help you increase your future pension and live a comfortable and independent life. And besides, PER (Plan Epargne Retraite) will allow you to reduce your tax base.

Sign up for a consultation Sign up for a consultation