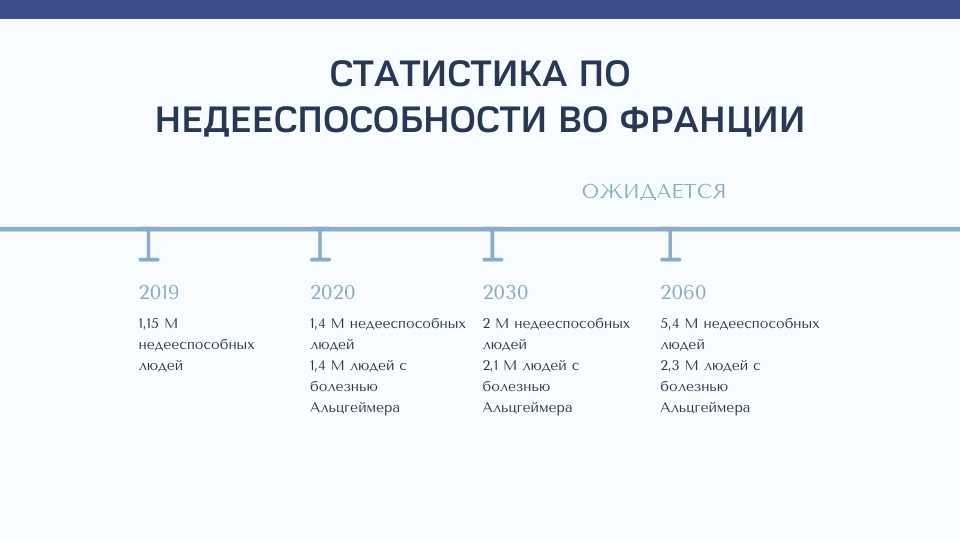

The standard of living is improving, medicine is becoming more effective, and life expectancy is increasing. However, this leads to the fact that the population is aging and the number of those who need outside help is growing (see statistics in the picture).

In France, if you lose autonomy, you can count on benefits APA. But this benefit may not be enough to maintain your usual standard of living.

Video about loss of autonomy

Entour'Age is the main frailty insurance offering on the French market today. Entour'Age was developed by AXA in partnership with the insurance company ANPERE, taking into account the real demographic situation and the frequency of cases of need for guardianship for older people in France. The main purpose of the contract is to offer the insured person (and his loved ones) specific solutions on the day when he begins to need constant care.

Senile infirmity is a possible future that we most often prefer not to think about, whether we are talking about ourselves, our loved ones, and especially our parents. However, in reality this is happening more and more often. The reason for this is both the increase in life expectancy and the improvement of medicine.

And then purely practical issues come to the fore:

- How long can a spouse (also elderly) help his wife who has become incapacitated?

- How to pay for the maintenance of an elderly person in a specialized medical institution, where a place costs from 1,500 to several thousand euros per month?

- What to do if all children live abroad, with the exception of one. Should he alone take on the entire burden of responsibility?

Entour'Age offers concrete solutions

This insurance contract provides a full range of services (both for the person in need of care and for his trustees) at the time of partial or complete incapacity and during the period of incapacity:

- Helping a person in need of care:

— preparation of documents for receiving assistance from the state,

— search for an assistant (assistant) for care,

— arrangement of housing.

2. Help for trustees:

- practical advice on caring for a frail person,

- assistance in organizing care,

- psychological support.

3. Support from loved ones who help you:

- searching for opportunities for their recreation.

4. Guarantees (in accordance with the Old Age Incapacity Insurance Guarantee of the French Federation of Insurers) a monthly payment of 500 to 3000 € in the event of total incapacity.

5. Allows you to receive monthly, in accordance with the insurance contract, an amount from 250 to 1500 € in case of partial incapacity.

6. Offers additional options:

- payment of the “first expenses” for home improvement in the amount of € 3,500 for work to refurbish the house for a person in need of care (for example, installing a seat or bar in the shower, equipping the stairs with a lifting mechanism),

– payment (to the persons specified in the contract) of the amount of 3500 € in the event of the death of the insured person,

— compensation (to the persons specified in the contract) of the premiums paid by the policyholder in the event of his death before reaching the age of 85 without loss of legal capacity.

The cost of insurance may become high for the policyholder if:

- he took out insurance when he was 75 years of age or older,

- included all possible options in the insurance,

- provided for the maximum possible payments in the event of partial or complete loss of legal capacity.

Good value for money can be achieved by taking out insurance at as young an age as possible, which will, among other things, avoid medical examination procedures. In addition, insurance at a young age will help protect yourself in cases of loss of legal capacity, which we prefer not to think about:

- stroke, which leads to complete or partial loss of capacity,

- the appearance of gradually increasing multiple sclerosis (orphan disease),

- traffic accident involving the driver himself.

Main advantages of Entour'Age

- AXA's Entour'Age offer is specific because it is developed on the basis of real-life situations of age-related incapacity, both from the point of view of the needs of the insured person himself - the need for a complete reorganization of daily life and, especially, additional costs - and in terms of the impact that this the situation is affecting his loved ones.

- The agreement implies a whole range of practical measures developed taking into account the real conditions faced by elderly people who have lost their legal capacity, on the one hand, and their guardians, perhaps also not too young and healthy, on the other.

- The contract provides for the payment of fixed insurance premiums, the amount of which does not depend on the age or state of health of the insured person. This condition allows you to avoid a situation in which you would be “squeezed in a vice” by having to pay unaffordable amounts of insurance, receiving a pension that practically does not increase.

- The pricing of the contract is at the average market level, and in some cases, according to Good Value for Money, even lower than the market level.

- AXA Groupe is financially resilient in relation to the risk associated with long-term contracts (potentially 30 to 60 years), so the policyholder can be confident that the insurer will be there when its assistance is needed.

Main disadvantages of Entour'Age

- A 12-month waiting period after activation of insurance (i.e. payment of the first premium) in the event of incapacitation due to illness. And 3 years of waiting, in case of neurological and psychiatric diseases. In this case, the loss of autonomy in the event of an accident begins to be paid immediately.

- 90-day deductible for the first payment of disability pension.

- The cost of an option that allows you to receive reimbursement (to the persons specified in the contract) of the premiums paid by the policyholder in the event of his death before reaching the age of 85 without loss of legal capacity, provided that the insurance has not been activated before this time.

Sign up for a consultation to learn more about financial protection for you and your loved ones.

— Did you like the article? Share with your friends!