Hurry up to jump into the last carriage! Declaration of income in France for 2022.

I remind my friends that today, May 22, 2023, is the last day for filing paper tax returns.

Anyone who lives in areas without access to the Internet, as well as those who are filing a declaration for the first time, need to have time to send it by mail in paper form.

All other taxpayers still have some time left to declare their income online.

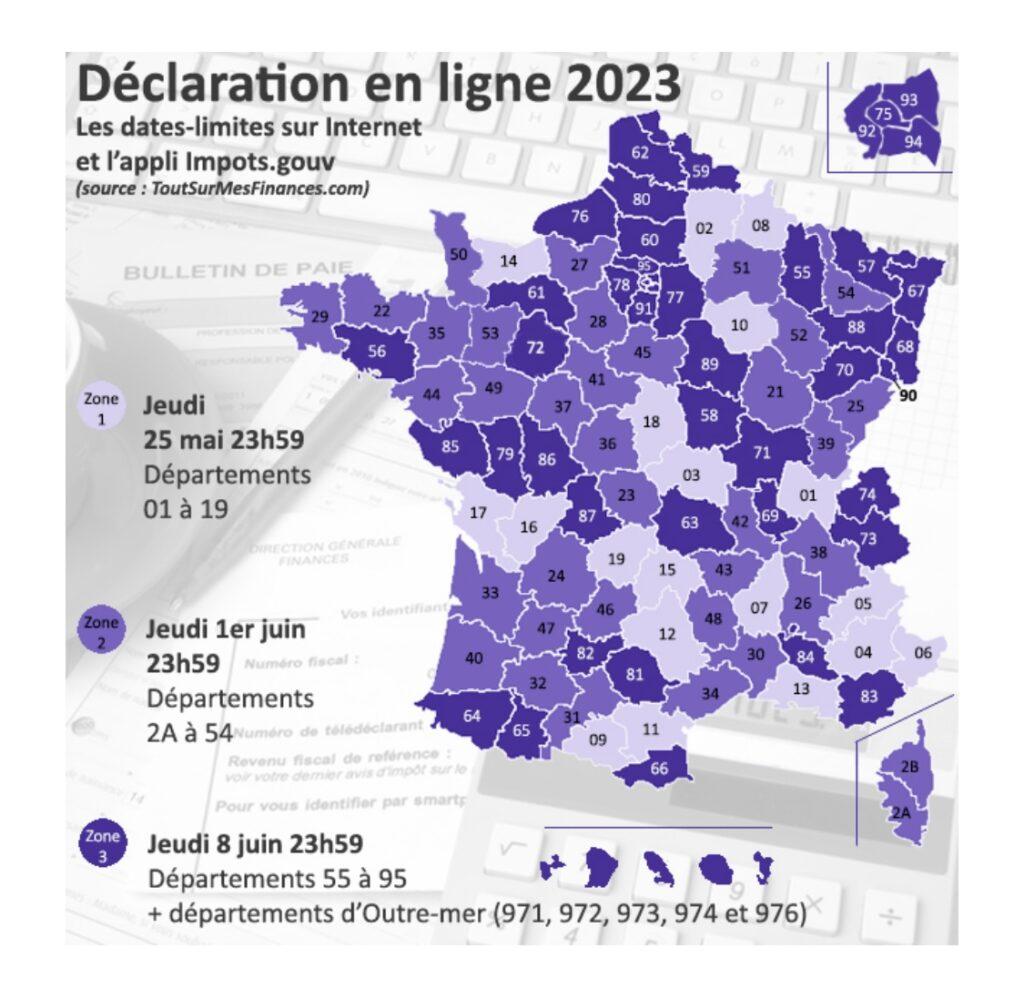

Deadlines for submitting online declarations by zone of residence

- Zone 1 (departments from 01 - Ain to 19 - Corrèze and non-residents who live permanently or more than 183 days a year in France) ─ until May 25, 23:59;

- Zone 2 (divisions 20 - Meurthe to 54 - Moselle) ─ until June 1, 23:59;

- Zone 3 (departments 55 - Meuse to 976 - Reunion) ─ until June 8, 23:59.

I advise you not to be late with sending. You will have to pay a penalty for late filing of your tax return.

The amount of tax payable will be increased by:

- 10% ─ if the declaration is sent later than the deadline, but before receiving official notification;

- 20% ─ if the declaration is filed within 30 days of receipt of official notification;

- 40% ─ if it is not filed within 30 days of receipt of legal notice.

- + additional interest to the fine in the amount of 0.2% of the tax amount for each month of delay.

IMPORTANT

Anyone who made contributions to voluntary pension savings or Prévoyance, Mutuelle, Dépendance insurance under loi Madelin/Fillon in 2022 ─ do not forget to deduct your contributions from your income.

This will help you reduce your taxes or get your overpaid taxes paid into your bank account.

If you haven’t done this yet ─ write to Direct right now or sign up for a consultation