Do auto-entrepreneurs pay pension contributions?

In France, any declared activity is subject to social charges, including pension contributions. Microentrepreneurs (the new name for auto entrepreneurs since 2016) are no exception.

We would like to remind you that this status, introduced in 2009, is only available to non-salaried employees (TNS) whose annual turnover does not exceed €176,200 (€170,000 before 1 January 2020) for trading activities, providing accommodation or €72,500 ( 70,000 € until January 1, 2020) for services and consultations (professions libérales).

One of the advantages of a micro-enterprise is that the micro-entrepreneur only pays social contributions if he has a turnover. Due to the lack of income from self-employment, he owes nothing. Consequently, a micro-entrepreneur who does not have a turnover is not subject, in particular, to old-age contributions and, therefore, does not have pension rights.

Pension funds for auto entrepreneurs

The inclusion of microentrepreneurs in mandatory pension plans is automatic: the self-employed person does not have to take any action. It is Urssaf that manages the contributions of micro-entrepreneurs, taking care, in particular, of their membership in the relevant pension schemes. However, some entrepreneurs who started liberal activities before 2018 have the opportunity to temporarily change the regime (see below). The pension plan of an auto entrepreneur depends on the nature of his activity.

- For artisans, tradesmen and professions libérales not included in the Interprofessional and Old Age Insurance Fund (Cipav):

- Basic pension plan: Assurance retraite*

- Supplementary pension scheme: Régime complémentaire des indépendants (RCI)

— For microentrepreneurs attached to Cipav

- Basic pension plan: basic plan managed by Cipav on behalf of the National Old Age Insurance Fund for the Liberal Professions (CNAVPL)

- Supplementary pension scheme: Cipav supplementary pension scheme

*National Old Age Insurance Fund (Cnav) for microentrepreneurs in Ile-de-France, Pension and Professional Health Insurance Fund (Carsat) for microentrepreneurs living in the regions, General Social Security Fund (CGSS) for microentrepreneurs living in Martinique, Guadeloupe, Reunion Island and Guyana.

Pension for car entrepreneurs attached to Cipav

Before 1 January 2018, the retirement rules for auto entrepreneurs were relatively simple: micro-entrepreneurs, traders and artisans contributed to the Social Regime for the Self-Employed (RSI) for a basic pension and to the Supplementary Scheme for the Self-Employed (RCI) for a supplementary pension, while While micro-entrepreneurs carrying out liberal activities and providing services depended on the Interprofessional Pension and Old Age Insurance Fund (Cipav), one of 11 liberal pension and provident funds, for basic and supplementary pensions.

On January 1, 2018, RSI was replaced by Social Security for the Self-Employed (SSI), which was gradually absorbed into the general Social Security system. From 1 January 2020, micro-entrepreneurs, traders and artisans joined the Pension Insurance Scheme, a basic pension scheme for private sector workers, artisans, traders, business executives and unlicensed agents. Civil service (contractual, temporary). RCI membership continues. This plan is currently managed by Assurance retraite.

Following a report from the Court of Auditors pointing out the dysfunctions of Cipav (errors in the calculation of pensions, non-payment of pensions, etc.), the Law on the Financing of Social Security (LFSS) in 2018 limited membership in the fund to 20 liberal professions, compared to more than 400 previously.

From January 1, 2018, only microentrepreneurs of the following liberal professions can join Cipav:

- architecte, architecte d'intérieur, économiste de la construction, maître d'œuvre, géomètre expert;

- ingénieur conseil;

- moniteur de ski, guide de haute montagne, accompagnateur de moyenne montagne;

- ostéopathe, psychologue, psychothérapeute, ergothérapeute, diététicien, chiropracteur;

- artiste non affilié à la Maison des artistes ou à l'Association pour la gestion de la Sécurité sociale des auteurs (Agessa);

- expert en automobile, expert devant les tribunaux;

- mandataire judiciaire à la protection des majeurs;

- guide-conferencer.

Other liberal microentrepreneurs, like their fellow traders and artisans, are associated with Assurance retraite for basic pension and RCI for supplementary pension. However, it appears that they do not actually contribute to the RCI, as revealed by the FNAE in a press release issued on January 13, 2021.

FNAE has received a draft government resolution on the distribution of contributions and social contributions to which micro-entrepreneurs are subject. Because if the fixed rates of social charges are known (12.8% for commercial and craft activities, 22% for liberal activities and services provided 22.2% on July 1, 2021), we do not know how this fixed rate is distributed. However, when reading the draft decree, FNAE noted that liberal microentrepreneurs not affiliated with Cipav do not pay additional pension contributions. The document provides that interested auto entrepreneurs will be able to contribute to RCI, subject to an increase in their social package by 5.1 points. On the other hand, due to the lack of contributions to RCI, nothing is planned for 2018, 2019 and 2020. At the moment, the decree has not yet been published in Journal Official.

Micro-entrepreneurs of professions libérales who are not included in the 20 professions covered by Cipav and who began their activities before 1 January 2018 can, if they wish, apply for pension insurance and (in theory) to the RCI before 1 January. 2023. To do this, they only need to submit a written request to join the pension insurance fund on which they will depend (Cnav in Ile-de-France, Carsat in the region of residence, CGSS of the overseas department and region [DOM-ROM] of residence). The Foundation will ensure that their membership in Cipav is terminated. In order for your membership to take effect on January 1 of the following year, you must submit a membership request Assurance retraite and RCI until October 30.

Please note: the option is non-refundable. A liberal microentrepreneur will not be able to return to Cipav after registering with Assurance retraite and RCI.

Conditions for confirming the quarter in order to confirm rights to the basic part of the pension

To receive a full basic pension, microentrepreneurs, like other workers, must prove a certain number of quarters, which depends on the year of their birth. Otherwise, they receive a basic pension at a reduced rate. Their basic pension is reduced by 1,25% for each missing quarter to 25% (equivalent to 20 quarters).

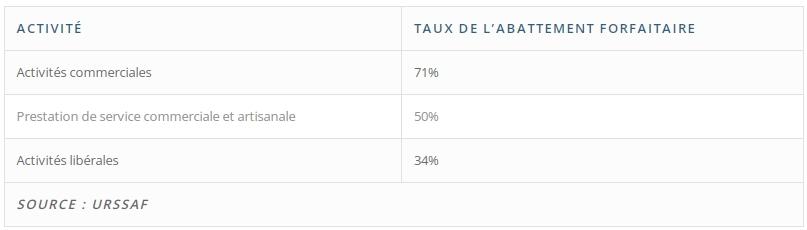

To qualify for retirement quarters, a microentrepreneur must meet annual professional income thresholds. This income corresponds to the turnover for the year minus the standard allowance, which depends on the nature of the self-employed person's activity. This abbreviation is applied automatically by Urssaf.

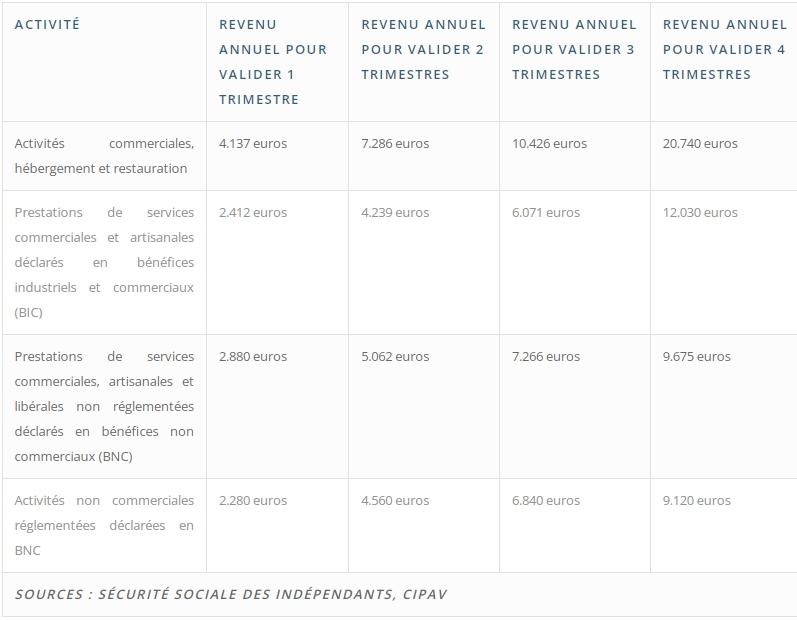

Annual income thresholds for qualifying for one or more quarters of retirement also vary depending on the nature of the microentrepreneur's activities. Here is the threshold scale for 2021.

The value of a point for the self-employed in 2021

The basic and supplementary pension schemes Cipav (for micro-entrepreneurs professions libérales) as well as the RCI (supplementary pension scheme for craftsmen, merchants and professions libérales not affiliated with Cipav) are schemes that accumulate points. Contributions allow you to accumulate points based on the point purchase price set each year. The accumulation of points allows you to calculate the amount of your pension, since the value of the point is also revalued annually.

Cipav Basic Point Cost 2021

Cipav's basic pension contributions are based on two contributions. Group A corresponds to an annual income (turnover minus the standard deduction) between €4,730 and the annual social security ceiling (Pass), or €41,136 in 2021. Group B is equivalent to the share of annual income between 1 and 5 Pass (from 41,136 euros to 205,680 euros).

The cost of purchasing a Cipav basic pension point is set at €6.44 in 2021. For micro-entrepreneurs who have achieved an annual income between €4,730 and €41,136, €6.44 in pension contributions paid through Urssaf to Cipav allows one to purchase 1 basic pension point in Cipav.

The purchase price of a Group B Cipav point is set at €153.84 in 2021. For the share of annual income between €41,136 and €205,680, the €153.84 basic pension contributions paid by Urssaf on Cipav allow the acquisition of 1 basic Cipav point.

The value of the Cipav basic pension point, which will determine the amount of the basic pension provided by Cipav to self-employed professions libérales, is set at €0.5731 in 2021.

Cost of additional Cipav point 2021

The number of additional Cipav pension points purchased is proportional to the amount paid by Urssaf as an additional pension contribution. An additional Cipav pension point is purchased for every €40.47 of additional pension contributions paid through Urssaf to Cipav.

The cost of the Cipav point, which will determine the amount of the additional pension, for self-employed professions libérales, is set at €2.63 in 2021.

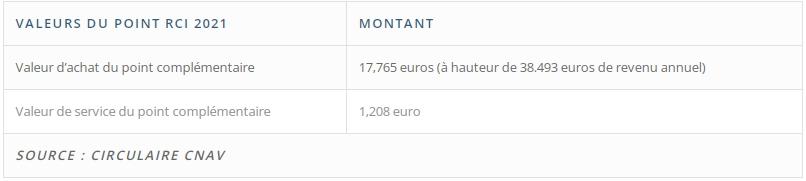

RCI Points 2021

The contribution ceiling for the Supplemental Contribution Plan (RCI) scheme is €38,493 in 2021. The purchase price of an RCI point is set at €17,765. Thus, RCI contributions of €17,765 allow you to receive 1 RCI point.

The value of the RCI point, which will determine the amount of the additional pension provided by the pension insurance under the RCI to an artisan, trader or self-employed professions libérales not linked to Cipav, is set at €1,208 in 2021.

About how to independently calculate your future pension. Read about pensions for people who are both employees and self-employed. article at the link...

Sign up for a consultation with me to find out what your pension will be and what solutions are available to increase it.

Source: https://partenaire.toutsurmesfinances.com/fd6u8m32/retraite-auto-entrepreneurs-2021-quelles-pensions-pour-les-micro-entrepreneurs-1203/#top