Deloitte conducted an analysis of the French insurance market to examine market trends. In January 2022, the study was published. Let's look at the main messages of this study, what has changed in a few months.

Evolution of the operating model

Customer relations and distribution have been particularly affected by the Covid-19 crisis since March 2020. Advisors remain at the center of the client relationship. However, insurers must become more reactive and efficient. This inevitably entails an increased need for digitization and optimization.

Digital technologies

Digital transformation and the use of cloud technologies may be the solution to these new problems.

26% French people use the insurance company's website and personal account to carry out their transactions.

Even if 77% French have an agency, only 43% go there at least once a year, and this figure is largely increased by bank insurance.

And this trend is declining; Deloitte estimates that only 10% of clients will visit an agency by 2025.

Beyond agency visits, the overall frequency of contact between an insurer and its policyholder is trending downward. Consumers expect greater personalization of services. In addition, 54% are interested in bonuses or customized offers that will take into account their lifestyle and consumption.

The model of relationships between insurers is gradually being restructured

- Multi-channel approach with a personal account as an entry point.

- Interpersonal qualities, clarity and simplicity of information will lead to increased customer awareness.

- New automation capabilities, internal chatbot, etc.

- Data assessment, operating models to optimize the processing and management of activities (client, company, consultant).

War for talent

Like many other sectors, there is a war for talent in insurance. Traditional talent models need to be rethought to address transformation challenges internal and external to the company.

It is important to interest employees not only with high wages, but also with working conditions.

Proof that the transformation has accelerated, only 3% of respondents believe their employees should return to the office full time.

Companies must offer employees a new remote work model. And it must take into account the nature of the work, experience and needs of the employee.

Sustainability issues

Challenges related to sustainable development create new expectations and

obligations in non-financial communications, investment policy and, more broadly, the obligations of insurers, which play an important economic and social role.

The adoption of non-financial standards entails new reporting obligations for insurers. Laws and regulations are being put in place that force companies to become more transparent in measuring their performance, both at the company level and at the product level.

Insurers will need to integrate biodiversity protection and issues

climate change in future investment policy. The cost of inaction and ecosystem degradation will amount to 7% of global GDP by 2050.

Insurers should start by raising awareness and training their employees and customers on these issues and consider the risk of biodiversity loss

in their investment, pricing and risk models.

Cyber risk insurance

Insuring digital risks is a real challenge for insurance companies. The digital security market is expected to reach $30 trillion in 2030. There has been a fourfold increase in attacks in France according to ANSSI since 2020 and a shortage of four million experts.

However, the difficulty is that data about attacks is not subject to disclosure, making it difficult to assess risks. There are also many “blind spots” in the legislation that do not allow guarantees and risks to be clearly defined.

Cyber risk is becoming more and more significant, and a new insurance model has yet to be invented, also taking into account the revolution of new technologies for protecting information systems and changes in legislation.

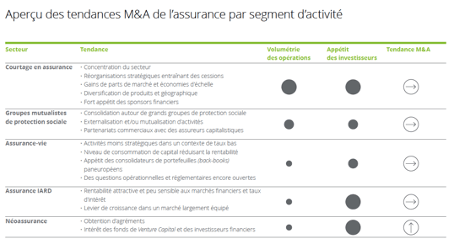

Mergers and acquisitions in insurance

Consolidation of activity and the influx of private capital in the context of low lending rates (which began to rise in 2022 as a result of the conflict between Russia and Ukraine) are two fundamental trends in insurance brokerage in France.

Traditional insurers are increasingly considering divesting Assurance Vie portfolios and repurposing their insurance contract.

Big players are multiplying mergers and partnerships to achieve

synergies to strengthen your offerings or support your business in the long term.

Financial communication in the era of IFRS17

IFRS 17 is scheduled to come into force in early 2023. Insurers continue to prepare for this key event, when they will have to rethink their financing in adverse economic conditions. The difficulty of this

The standard creates serious problems in the preparation of financial statements and

announcement of results.

IFRS requires insurers to disclose key information about the new measure of future profitability. Which will allow investors to better assess the company's future profits and risks.

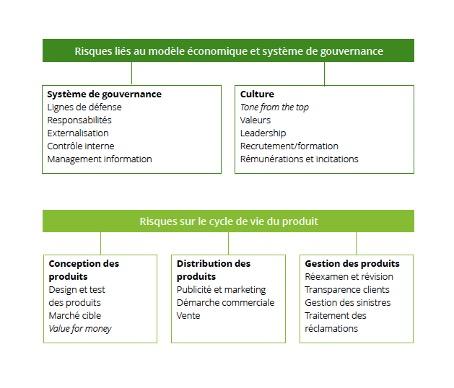

Liabilities related to business activities

Oversight of business practices has evolved since 2019 to include corporate culture and customer value. Today the problem is to consolidate initiatives related to the risk of misconduct, risks, within a common structure, to determine management indicators and spread the risk culture within the company.

Aggressive sales and commercial practices aimed at maximizing profits without taking into account the interests of the client by some players lead to a loss of client confidence in the entire insurance sector as a whole.

In 2010, in France, the ACPR created an office to monitor behavioral risk, an unethical commercial practice of insurance and financial institutions.

Companies need to implement ethical behavior internally and towards customers. Compliance by employees with the rules of professional ethics, between them and in relation to clients should become an integral practice in insurance companies.