If you want to extend your life in retirement, you can, under certain conditions, pay off quarters by making payments into RGSS. This is possible for those who have completed higher education or if you do not have enough quarters for partial years of contributions (confirmed in less than 4 quarters per year). This also applies to certain periods of apprenticeship or periods of nannying.

Conditions

Years of study

If you have completed higher education, you can ask for pension quarters to be repaid if you were connected to the general scheme (Régime General) at the end of your studies.

You must have a French diploma from a higher education institution (école technique supérieure, une grande école) or a preparatory class for these schools.

For the purpose of repayment, the presence of a diploma in one of the following countries is taken into account:

- European Economic Area countries;

- Switzerland;

- Countries linked to France by an international social security agreement (sécurité sociale).

Preparatory classes for admission to Grandes Ecoles are equivalent to obtaining a diploma.

During these years of study you should not have been associated with any mandatory pension scheme (régime de retraite obligatoire).

Age requirement

You must be between 20 and 66 years of age on the date you apply.

Please note that if you are already receiving a General Scheme Old Age Pension, you can no longer pay off your retirement quarters.

Types of repayments

You can ask to repay quarters:

- or at the calculated labor pension rate (which makes it possible to reduce or cancel the reducing rate decote),

- or by the rate and duration of insurance used to calculate the pension.

Once a choice has been made, it cannot be changed.

You can make quarterly redemptions multiple times.

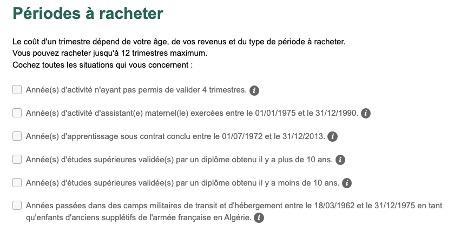

You can also combine repayments for higher education years with other repayments if you meet the following conditions:

- Incomplete years during which your professional activity did not allow you to confirm 4 quarters.

- Periods of training or work as a nanny.

Redemption requests are only accepted for full quarters (1 to 12). Each quarter must include a period of 90 consecutive days giving the right to redeem the quarters.

Repayment may not allow you to reaffirm more than 4 quarters per year.

All repayments taken together cannot exceed 12 quarters.

Repayment simulator

You can simulate the cost of repayment of quarters on the pension insurance website from your personal account.

If at the end of this simulation you would like to make a redemption request, please download the suggested request form. And send it to the address you specified.

https://www.lassuranceretraite.fr/portail-services-ng/sec/dashboard/service/VPLR

Payment

The cost of a quarter depends on your age, income, type and period of repayment.

The requested amount can be paid at one time or in several monthly installments (if repaid in at least 2 quarters).

Note: If the payment is spread over more than one year, the remaining amount increases each year.

You can deduct the repayment amount from your taxable income.

Redemption of AGIRC-ARRCO points

It is useful to know that you can also redeem additional pension points from Agirc-Arrco if this redemption relates to years of study at a higher education institution in accordance with articles 46 and 47 of the National Interprofessional Agreement of November 17, 2017.

You can redeem 140 points per year (for three years), their value is calculated based on:

- the value of each point,

- The increasing or decreasing coefficient depends on the retirement age,

- variable coefficient, which changes based on age, etc.

Which is better, PER or repayment of quarters (rachat des trimestres)?

Before you rush headlong to buy up blocks, I recommend comparing how much it will cost you to buy them back and the annuity forecast if you invest the same amount in an individual savings pension plan PER. In my experience, the second one is more profitable, but it’s impossible to say for sure, because the cost of repayment depends on several criteria:

- your age,

- type of repayment,

- number of quarters earned,

- selected options, etc.

So I suggest you make an appointment with me for a consultation. I will calculate everything for you and tell you which solution will be best in your situation.

Sources: