Do you dream of investing in real estate, but don't have enough money for a down payment? Or don’t know which properties are best to invest in to get a stable income? Or maybe high taxes and low liquidity are stopping you? In this article you will learn how to invest in quality properties starting from 1K € within the framework of the Assurance Vie tax benefit.

Financial market 2021, forecasts of financial market experts

Overall, financial market professionals predict growth. This optimism is associated with the following factors:

- Mass vaccination in Europe and the United States is expected to lead to herd immunity this summer.

- Continued unprecedented stimulation of the European economy, injecting €170 billion (5.4% GDP) over 3 years and €1900 billion (8.7% GDP) into the US economy.

- In the USA, GDP growth is expected to be 6.2%, against growth in Europe of 3.6%.

- Fear of inflation has caused increased volatility in the bond market.

Such measures, however, raise concerns among experts who predict rising inflation.

As for asset classes, experts expect growth in the stock and commodity markets.

Reasons to invest in real estate

Historically, the French have preferred to invest in real estate. This asset class allows you to protect your investments by:

- Diversification of investments, real estate prices show low correlation with other asset classes.

- Investments in real estate are characterized by stable long-term returns.

- And if we talk about the high risk of rising inflation, then real estate will protect your investments in the current conditions.

However, it is important to remember that when investing in real estate, it is better to entrust its selection to experienced experts who know how to select high-quality properties, reduce the risk of non-payment from rental, and, accordingly, increase the profitability of your investment.

What is AXA Selectiv Immo Service

As you know, investing in real estate requires serious capital and experience in searching and selecting real estate and tenants. Thus, not everyone may have access to this long-term investment vehicle.

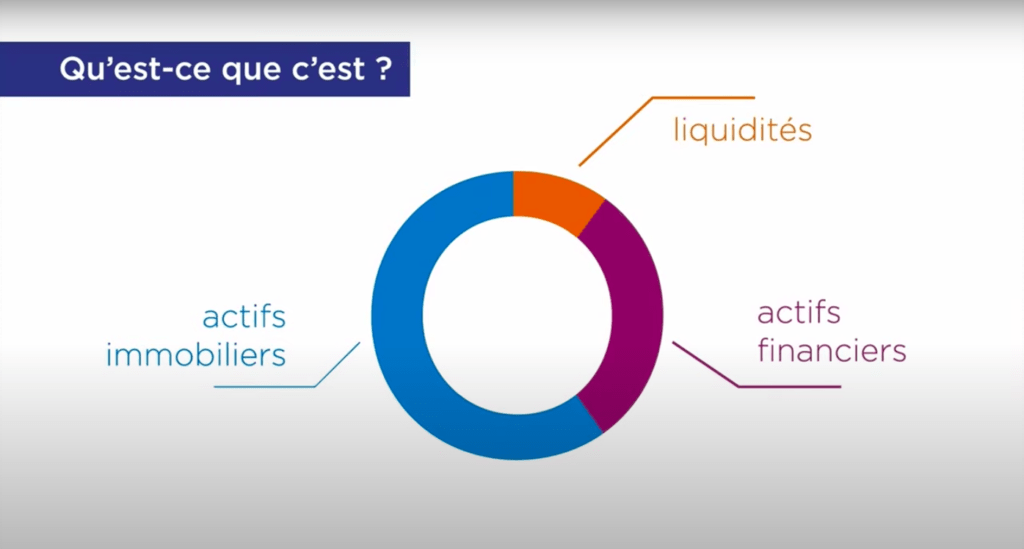

OPCI AXA Selectiv Immo Service is an affordable way to invest in real estate. OPCI is a collective real estate investment organization. They consist of real estate assets, financial assets and liquidity to diversify the portfolio.

Portfolio assets:

- hotels,

- entertainment centers,

- educational establishments,

- housing for students,

- medical institutions,

- nursing home,

- residential residences, etc.

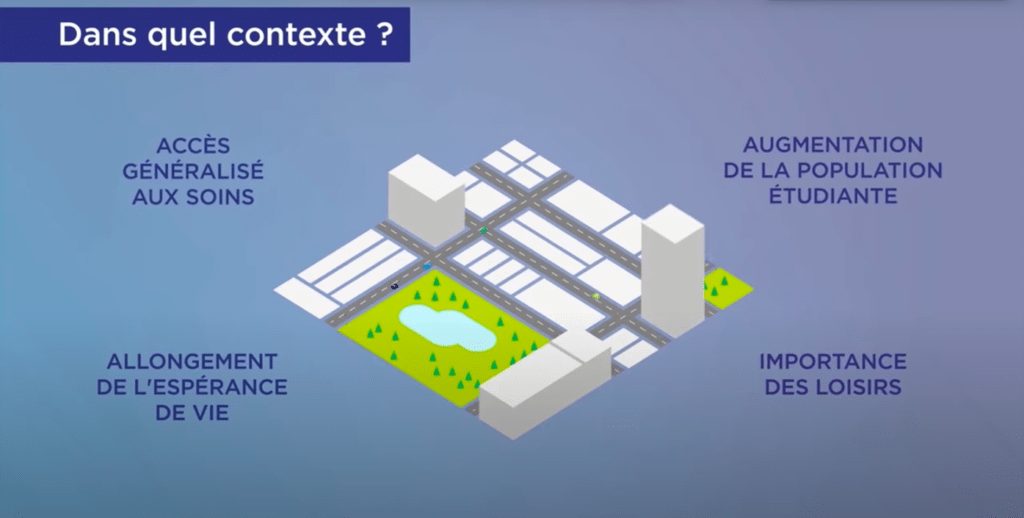

The choice of assets is justified by increased demand for medical services and entertainment, an increase in the number of students and an increase in life expectancy.

AXA Selectiv Immo Service allows you to diversify your real estate investments, both geographically and across asset classes. These are long-term investments, the recommended period is 8 years. At the same time, within the framework of the Assurance Vie dispositive, you can take advantage of the tax benefit.

3 main reasons to invest in real estate through AXA Selectiv Immo Service:

- Receiving regular income and increasing the value of real estate in the long term.

- Low threshold for access to the high-quality real estate market.

- Competencies of market leader experts.

Real estate market overview

The real estate market has been affected by the health crisis associated with COVID-19. However, prices across asset classes did not behave in the same way. For example, residential and logistics properties have increased in price while commercial and hotel properties have fallen. And despite this, experienced managers of OPCI AXA Selectiv Immo Service continue to invest in assets that have fallen in price, which will lead to increased profitability in the future.

To summarize, market experts expect an increase in tenant activity after the end of isolation and the easing of sanitary measures.

Real estate investing will always exist. This is an effective investment diversification tool, a source of stable income and protection against inflation.

What is important when buying real estate

The most important thing is the location. The COVID-19 crisis has made it even more clear that now, more than ever, it is important to be able to find and invest in quality real estate.

Fund managers select properties that are well located and of high quality. Such assets meet high demand, which means they can choose among reliable and solvent tenants.

The manager of OPCI AXA Selectiv Immo Service confirms that from the very beginning of the establishment of the fund, the organization has not experienced an outflow of tenants. Experts are optimistic and expect high market growth in the near future.

What is the difference between investing in real estate and in OPCI AXA Selectiv Immo Service under the Assurance Vie tax benefit

Strengths of real estate investing:

- Long-term value growth.

- Regular income.

Minuses:

- High taxes on income and inheritance.

- Low liquidity.

- Low diversification. You can buy one property, and if this is the only investment, then the result is low diversification. And this, in turn, significantly increases the risk of your investment.

OPCI solves all these disadvantages. By investing in real estate through this financial instrument, you get the following advantages over purchasing a real property:

- More favorable taxation under Assurance Vie.

- Management is carried out by real estate market professionals who have daily experience.

- The process of passing on your investments by inheritance is greatly simplified under Assurance Vie.

- Access to investments from 1,000 €.

- Total diversification: geographical and by asset class.

How to start investing in real estate through OPCI AXA Selectiv Immo Service

You can contact me by clicking on the button and scheduling a consultation.

Or, if you already have an investment contract with AXA, you can do this yourself through your personal account, following the video instructions. Instructions start at 26 min.

Write your questions in the comments, I will be glad to answer them.