Travailleur non salarier (hereinafter - TNS) are entrepreneurs, artisans, merchants, independent professions (hereinafter - Profession Liberale), heads of companies (hereinafter - Gerants societé) art 62 of the Tax Code (hereinafter CGI).

Here is an interesting video about what you need to know before become a Profession Liberale in France.

What do they have in common?

What they all have in common is that they are the most vulnerable group in France. This applies to pensions and social guarantees. But this can be fixed. If you are TNS, you can sign Prévoyance contract and protect yourself and loved ones in the event of death, disability, disability or illness. Voluntary health insurance also belongs to this type of contract.

In previous posts, we said that entrepreneurs can reduce the tax base by making contributions to an additional pension, using either the Madelin or Fillon tax disposition.

Today we will discuss protection against loss of income - Prévoyance and additional health insurance (mutuel), and how to use it to reduce income taxes.

How to reduce income tax in France through insurance premiums

So, contributions to Prévoyance and health insurance under loi Madelin are deducted from professional income, that is:

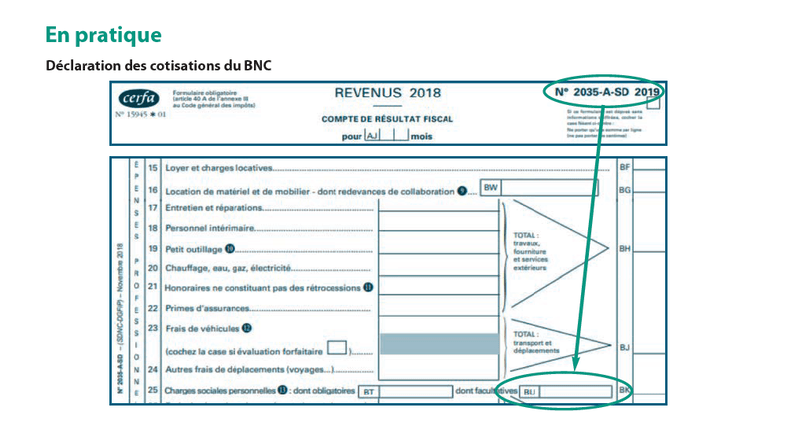

- Déclaration 2035 for Profession Liberal with BNC tax regime;

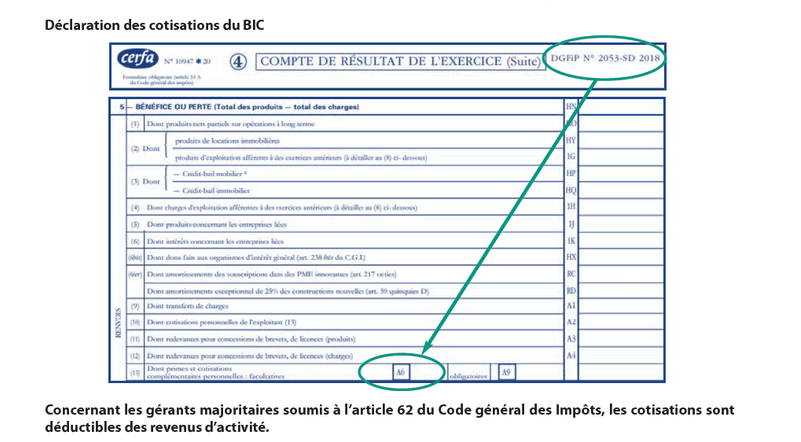

Declaration 2053 for artisans and merchants (Artisans and Commerçantes) with BIC tax regime;

Declaration 2053 for artisans and merchants (Artisans and Commerçantes) with BIC tax regime;

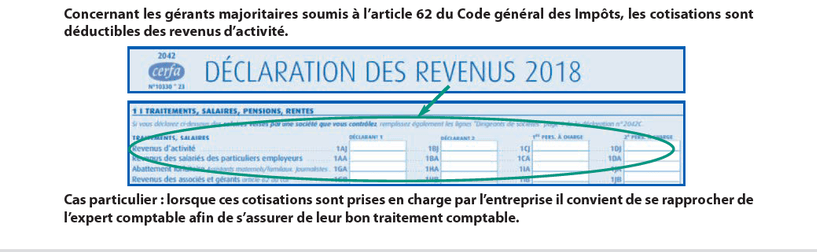

- Gérants societé art 62 CGI deduct contributions from professional income.

Attention! Entrepreneurs with micro-entrepreneur status cannot use the Madelin dispositive.

Amount of deductible contributions

The amount of contributions that can be deducted from income tax is limited by enveloppe fiscal. This means that up to this amount you can deduct insurance premiums from your BIC/BNC or professional income, depending on your tax regime. It is calculated by the formula:

Disponible Madelin SANTÉ-PRÉVOYANCE

(7 % x PASS) + (3.75 % x BIC/BNC)

Plafond: 3 % x 8 PASS

BIC – business income

BNC - income from non-commercial activities

PASS – annual social security ceiling, €41,136 in 2021.

The ceiling on deductible contributions in 2021 will be €9,872.

Let's look at an example

Misha Ivanov is an architect, he has his own architectural bureau, Mikhail’s income BNC: 45 K€. TMI-30%

We calculate the amount of contributions that can be deducted from income

(7 % x PASS) + (3.75 % x BIC/BNC)

7% x 41,136€ + 3.75 % x 45,000 = 2879.5 + 1687.5 = 4,567€

Mikhail can deduct medical fees. insurance and Prévoyance contract in the amount of €4,567 in 2021 (PASS changes every year and the contribution ceiling must be recalculated accordingly). And thanks to his contributions, Mikhail will reduce income tax by 1370 € (enveloppe fiscal x TMI = 4,567 x 30%).

If Mikhail uses my recommendations, he will not only protect himself and his loved ones from financial problems in case of illness, death and disability, but will also provide himself with an additional pension. And if we add up 3 contracts - pension, medical and Prévoyance, then the tax savings will be 1370 € + 1523 € = 2893 € (6% of total income).

Taxation of benefits

We have looked at how profitable it is to make contributions, now let's figure out how benefit payments will be taxed if an insured event occurs.

Payment of medical expenses within the framework of health insurance and maternity benefits are completely exempt from tax. Great news, isn't it?

As for paying for disability benefits, everything doesn’t look so clear anymore:

- Temporary disability benefits, then IJ (Indemnités Journalières) and category 1 disability annuity (while maintaining professional activity) are included in professional income BIC/BNC and taxed at standard tax scale IR.

- Disability annuity of categories 2 and 3 (without maintaining professional activity), spouse's pension, annuity for children's education are taxed according to the pension and annuity scale RVTG (rente viagère à titre gratuit) art. 158-5 CGI.

In addition, these benefits will have to pay social security contributions (hereinafter referred to as PS).

At that time, if you do not select the Madelin option, then IJ and disability annuity paid under the optional additional Prévoyance insurance are also exempt from income tax and from PS.

Accordingly, before applying the Madelin dispositive to Prévoyance voluntary insurance, you should first think about it. Yes, you will save on tax when paying premiums, but you will pay tax on benefits in the event of an insured event.

If you want to improve your financial protection and at the same time optimize taxes, sign up for a consultation with me, I will calculate your enveloppe fiscal and select a solution that will suit your needs and capabilities.

Healthy? Save it and share it with your friends.